Portfolio philosophy, principles & practices

The Foundation believes endowments are forever. Ensuring the university has a stable revenue source to fund projects and research of vital importance is what drives the Foundation’s long-term investment horizon and focus on long-term returns.

As investors, the Foundation Board believes Responsible Investing that takes environmental, social and governance (ESG) factors into consideration, is an important determinant of long-term financial performance and investment returns. We are committed to updating plans to ensure important ESG risk and opportunity considerations, including climate change, are a part of investment strategies for all asset classes.

For more information, please see the following frequently asked questions.

UVic Foundation's investment objectives

The endowment funds of the University of Victoria Foundation (the “Foundation”) are invested in accordance with the Foundation’s Statement of Investment Objectives and Guidelines (SIO&G). The SIO&G sets out the categories of permitted investments, diversification, asset mix and rate of return expectations. A fundamental underlying concept is that the Foundation’s endowed assets are intended to exist in perpetuity.

As a result, the Foundation has a long-term investment horizon and focuses on long term returns. The investment objectives of the Foundation reflect this and are focused on:

- preservation of capital in real terms;

- generation of sufficient annual cash flow to meet annual distribution requirements; and

- growth of the retained assets to meet rising costs over the long term.

The SIO&G is reviewed annually by the Board of Directors of the Foundation.

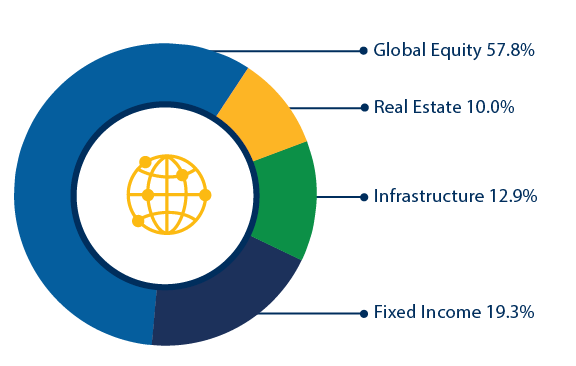

The Foundation’s Main Investment Pool is constructed with an asset mix biased to equity investments, representing a fully diversified mix of asset classes optimized based on forecasts of risk and return, which may include equities, fixed income, real estate, infrastructure assets, private equity and hedge funds.

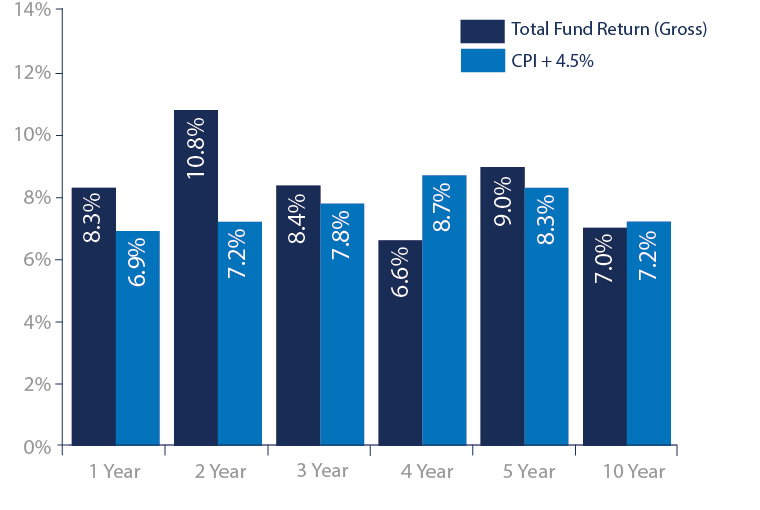

The long-term investment goal of the fund is to achieve a minimum annualized rate of return of 4.5% in excess of the Canadian Consumer Price Index. Elevated inflation and ongoing geopolitical uncertainty continue to impact market conditions and has resulted in the fund experiencing mixed performance results relative to the investment goal. The fund exceeded its benchmark over most short and medium-term periods but underperformed over the 4-year and 10-year periods.

Main Investment Pool Gross Return Relative to Investment Goal

Total Gross Fund Return vs Investment Goal of CPI + 4.5%, as at March 31st, 2025

Main Investment Pool Actual Asset Allocations

Assets Under Management $608.0 million, as at March 31st, 2025

The Foundation's actual allocation to each asset class remains within the approved investment policy ranges.

The Foundation’s long-term investment goal is to achieve a minimum annualized rate of return of 4.5% in excess of the Canadian Consumer Price Index. The Main Investment Pool has outperformed its goal over the last 10 years.

The Fossil Fuel Free Investment Pool (“FFFIP”) is an alternative investment option for donors who prefer to not have their endowed donations invested in companies directly involved in the extraction, processing and transportation of coal, oil or natural gas “fossil fuels”. The FFFIP also excludes companies included in the “Carbon Underground 200” list. The FFFIP was created in 2016 in direct response to student and faculty calls for action to address climate change and provide donors a fossil fuel free investment option. The FFFIP was seeded by the university with $25K from working capital. With help from student feedback over the past year to increase awareness of donor investment options, the FFFIP has grown assets under management to over $1.9 million in 2022.

In 2020, the Foundation changed the FFFIP’s manager and rebalanced the equity only pool with an asset mix consisting of a 65% allocation to equities and a 35% allocation to fixed income, to better diversify the pool and reduce its volatility. While the FFFIP is still less diversified than the Main Investment Pool and may exhibit higher volatility and risk, both pools are expected to offer comparable long-term performance meeting the Foundation’s investment goals.

The FFFIP returned 11.8% in the past year, outperforming the investment objective of CPI + 4.5% by 4.9% while matching the performance of the investment benchmark.

FFFIP Actual Asset Allocations

Assets Under Management $1.9 million, as at March 31st, 2025