Donor investment options

Establishing an endowment is a great way for you to make large, transformative gifts to University of Victoria. Endowing your donation allows you to have a long-term impact on the university that will provide a perpetual annual benefit.

Endowed gifts are invested and stewarded by the University of Victoria Foundation to create steady investments returns, paying out a yearly amount while the principal grows over the years and preserves purchasing power. Compared to annually funded gifts that have an immediate but short-term impact, endowments and their related benefits last forever. They generate stable funding for donor-specified purposes, such as scholarships, fellowships, chairs, buildings, academic programs or the university’s greatest needs. At this time, the minimum amount for establishing a named endowed fund is $25,000. Endowed funds may be named to honour a person, family or organization.

Donors may choose if any newly created endowments are invested in either the Main Investment Pool or in the Fossil Fuel Free Investment Pool. Regardless of which pool is selected, the University of Victoria development office will work closely with donors to create new endowments that can ensure support to the area of their selection.

The Main Investment Pool

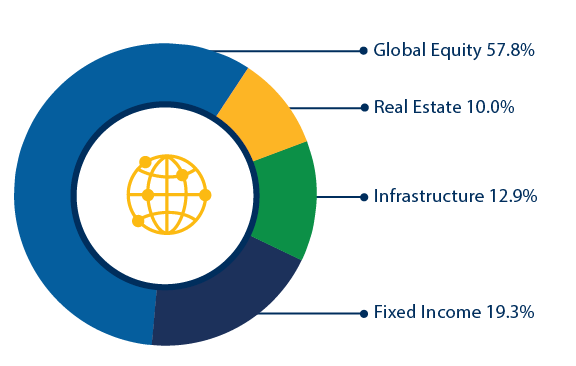

The Main Investment Pool is a diversified investment pool that, on an asset class level, invests in Equities, Fixed Income, Real Estate and Infrastructure. The investment managers include: Phillips, Hager & North (Fixed Income), Baillie Gifford (Global Equities), Pier 21/C WorldWide (Global Equities), Walter Scott (Global Equities), Macquarie (Infrastructure), Brookfield (Infrastructure), and BentallGreenOak (Real Estate).

Main Investment Pool Actual Asset Allocations

Assets Under Management $608.0 million, as at March 31st, 2025

The Foundation's actual allocation to each asset class remains within the approved investment policy ranges.

Fossil Fuel Free Investment Pool

The Fossil Fuel Free Investment Pool is an alternative investment option for donors who prefer to not have their endowed donations invested in directly involved in the extraction, processing and transportation of coal, oil or natural gas “fossil fuels”. The Fossil Fuel Free Investment Pool also excludes companies within the “Carbon Underground 200” list.

This pool is a diversified investment pool that, on an asset class level, invests in Equities and Fixed Income. The investment manager is Phillips, Hager and North.

Actual Asset Allocations

Assets Under Management $1.9 million, as at March 31st, 2025